This course provides a comprehensive, hands-on approach to relative valuation techniques used in modern financial analysis. Learners will explore, differentiate, and apply valuation ratios such as Price-to-Earnings (P/E), Price-to-Book Value (PBV), and Enterprise Value (EV) metrics to assess company worth in relation to peers. Through structured modules, the course builds from foundational principles to advanced benchmarking, integrating real-world financial statements and comparative analysis models.

Comprehensive Relative Valuation Training

Skills you'll gain

- Financial Modeling

- Return On Investment

- Benchmarking

- Cash Flows

- Business Valuation

- Financial Analysis

- Equities

- Financial Statements

- Financial Data

- Financial Statement Analysis

- Investment Management

- Skills section collapsed. Showing 10 of 11 skills.

Details to know

Add to your LinkedIn profile

15 assignments

See how employees at top companies are mastering in-demand skills

There are 5 modules in this course

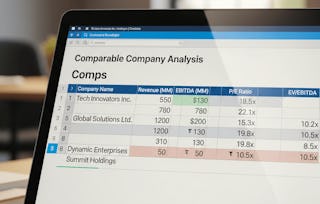

This module introduces the concept of relative valuation, explains its advantages and limitations, and explores core valuation multiples like P/E, EV/EBITDA, and Book Multiples. It sets the foundation for understanding how companies are valued through comparisons with similar firms.

What's included

6 videos3 assignments

This module delves into essential financial multiples used in relative valuation, including Price to Earnings (P/E), Price to Book Value (PBV), Price to Sales (P/S), and PEG ratios. It also clarifies the differences between enterprise value and equity value, and their role in selecting ratios.

What's included

11 videos3 assignments

This module explains the process of selecting comparable companies, gathering financial data, and building a benchmarking framework. It emphasizes techniques for performing Comparable Company Analysis (CCA) to derive a firm's value from its peers.

What's included

7 videos3 assignments

This module covers the integration of financial statements into valuation models, focusing on adjustments to income statements, benchmarking analysis, and construction of sheets for specific companies to derive valuation inputs from real data.

What's included

11 videos3 assignments

This module focuses on the interpretation of output sheets, benchmarking summaries, and advanced valuation metrics including DCF integration, operating leases, and reinvestment rates. It prepares learners to present complete, data-driven valuation analyses.

What's included

10 videos3 assignments

Why people choose Coursera for their career

Felipe M.

Jennifer J.

Larry W.