Learners will be able to analyze option contracts, evaluate pricing drivers, apply trade lifecycle controls, assess client onboarding risk, and interpret ISDA documentation used in global derivatives markets. They will also be able to explain market infrastructure, settlement processes, and reference data frameworks that support derivatives trading operations.

Analyze & Apply Derivatives, Options and ISDA Frameworks

Analyze & Apply Derivatives, Options and ISDA Frameworks

This course is part of Analyze Investment Banking Operations & Markets Specialization

Instructor: EDUCBA

Access provided by ExxonMobil

Recommended experience

What you'll learn

Analyze options, pricing drivers, and derivatives trade economics.

Apply trade lifecycle controls, client onboarding, and risk frameworks.

Interpret ISDA documentation and post-trade processes in derivatives markets.

Skills you'll gain

Details to know

Add to your LinkedIn profile

30 assignments

January 2026

See how employees at top companies are mastering in-demand skills

Build your subject-matter expertise

- Learn new concepts from industry experts

- Gain a foundational understanding of a subject or tool

- Develop job-relevant skills with hands-on projects

- Earn a shareable career certificate

There are 8 modules in this course

This module introduces the fundamental concepts of options trading, including put and call options, payoff structures, moneyness, intrinsic value, and time value, forming the conceptual foundation for derivatives in investment banking.

What's included

7 videos4 assignments

This module explores the drivers of option pricing, settlement mechanics, trade economics, and the role of equity characteristics in derivatives valuation and lifecycle management.

What's included

6 videos4 assignments

This module provides a comprehensive view of the end-to-end trade lifecycle, emphasizing operational controls, confirmations, reconciliations, and settlement processes in financial markets.

What's included

4 videos3 assignments

This module examines regulatory-driven client onboarding, customer acceptance policies, risk categorization, customer identification procedures, and due diligence frameworks.

What's included

7 videos4 assignments

This module applies onboarding and due diligence concepts through practical case studies, reinforcing risk-based decision-making and documentation standards.

What's included

4 videos3 assignments

This module introduces the ISDA framework, focusing on legal documentation, contractual obligations, default events, termination rights, and credit support mechanisms in OTC derivatives.

What's included

8 videos4 assignments

This module focuses on ISDA documentation flow, practical application, governance, and industry best practices that support legal certainty and risk management.

What's included

9 videos4 assignments

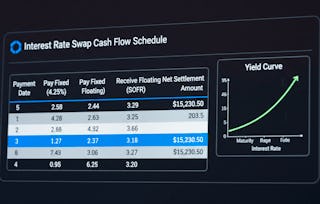

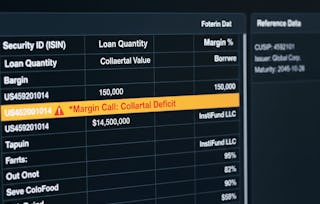

This module covers market infrastructure components, margining, defaults, financial messaging systems, reference data management, and settlement operations.

What's included

30 videos4 assignments

Earn a career certificate

Add this credential to your LinkedIn profile, resume, or CV. Share it on social media and in your performance review.

Why people choose Coursera for their career

Felipe M.

Jennifer J.

Larry W.