By the end of this course, learners will be able to identify key securities identifiers and reference data, explain securities borrowing and lending and collateral management processes, apply options strategies for risk management, analyze major financial risks, and evaluate the role of global regulatory frameworks such as MiFID and international supervisory bodies.

Analyze Investment Banking Operations, Risk & Regulation

il reste 3 jours ! Acquérir des compétences de haut niveau avec Coursera Plus pour 199 $ (régulièrement 399 $). Économisez maintenant.

Analyze Investment Banking Operations, Risk & Regulation

Ce cours fait partie de Spécialisation Analyze Investment Banking Operations & Markets

Instructeur : EDUCBA

Inclus avec

Expérience recommandée

Ce que vous apprendrez

Identify securities reference data and explain securities lending and collateral processes.

Apply options strategies and analyze key financial risks in banking operations.

Evaluate global regulations and supervisory frameworks impacting investment banking.

Compétences que vous acquerrez

- Catégorie : Operational Analysis

- Catégorie : Bank Regulations

- Catégorie : Securities Trading

- Catégorie : Financial Regulation

- Catégorie : Risk Analysis

Détails à connaître

Ajouter à votre profil LinkedIn

janvier 2026

30 devoirs

Découvrez comment les employés des entreprises prestigieuses maîtrisent des compétences recherchées

Élaborez votre expertise du sujet

- Apprenez de nouveaux concepts auprès d'experts du secteur

- Acquérez une compréhension de base d'un sujet ou d'un outil

- Développez des compétences professionnelles avec des projets pratiques

- Obtenez un certificat professionnel partageable

Il y a 8 modules dans ce cours

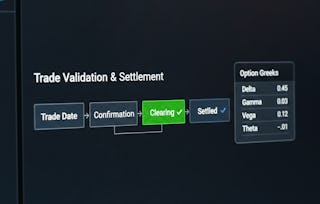

This module introduces the foundational building blocks of post-trade investment banking operations, focusing on global security identification systems, Standard Settlement Instructions (SSIs), and reference data management. Learners gain practical insight into how accurate identifiers and static data enable efficient trade processing, reduce settlement failures, and mitigate operational risk.

Inclus

9 vidéos4 devoirs

This module explores the structure and purpose of securities borrowing and lending markets, including participants, loan types, benefits, risks, and reporting requirements. Learners understand how SBL supports liquidity, short selling, and market efficiency while introducing operational and credit risk considerations.

Inclus

12 vidéos4 devoirs

This module provides a detailed view of collateral management within investment banking operations, covering collateral types, key parties, operational workflows, and relationship management. Learners gain insight into how collateral mitigates counterparty risk and introduces operational complexity.

Inclus

9 vidéos4 devoirs

This module introduces core options strategies used for hedging and income generation, including calls, puts, covered strategies, and protective techniques. Learners understand risk–reward profiles and the strategic application of options in different market conditions.

Inclus

13 vidéos4 devoirs

This module advances learners’ understanding of complex options strategies and derivatives frameworks, including ISDA documentation, volatility-based strategies, and multi-leg spreads. The focus is on structuring precise risk–return outcomes in sophisticated market environments.

Inclus

11 vidéos4 devoirs

This module examines key financial risks faced by investment banks, including market, credit, liquidity, and operational risk. Learners explore causes of risk and practical mitigation techniques used in real-world banking environments.

Inclus

13 vidéos4 devoirs

This module introduces the structure and objectives of financial regulation, emphasizing the role of international regulators in maintaining systemic stability. Learners understand how regulatory oversight supports market integrity and cross-border coordination.

Inclus

4 vidéos3 devoirs

This module focuses on global regulatory coordination and the Markets in Financial Instruments Directive (MiFID). Learners examine regulatory requirements, transparency rules, and the operational impact of compliance on investment firms.

Inclus

5 vidéos3 devoirs

Obtenez un certificat professionnel

Ajoutez ce titre à votre profil LinkedIn, à votre curriculum vitae ou à votre CV. Partagez-le sur les médias sociaux et dans votre évaluation des performances.

En savoir plus sur Finance

Statut : Essai gratuit

Statut : Essai gratuit Statut : Essai gratuit

Statut : Essai gratuit Statut : Prévisualisation

Statut : Prévisualisation Statut : Essai gratuit

Statut : Essai gratuit

Pour quelles raisons les étudiants sur Coursera nous choisissent-ils pour leur carrière ?

Felipe M.

Jennifer J.

Larry W.

Chaitanya A.

Foire Aux Questions

To access the course materials, assignments and to earn a Certificate, you will need to purchase the Certificate experience when you enroll in a course. You can try a Free Trial instead, or apply for Financial Aid. The course may offer 'Full Course, No Certificate' instead. This option lets you see all course materials, submit required assessments, and get a final grade. This also means that you will not be able to purchase a Certificate experience.

When you enroll in the course, you get access to all of the courses in the Specialization, and you earn a certificate when you complete the work. Your electronic Certificate will be added to your Accomplishments page - from there, you can print your Certificate or add it to your LinkedIn profile.

Yes. In select learning programs, you can apply for financial aid or a scholarship if you can’t afford the enrollment fee. If fin aid or scholarship is available for your learning program selection, you’ll find a link to apply on the description page.

Plus de questions

Aide financière disponible,