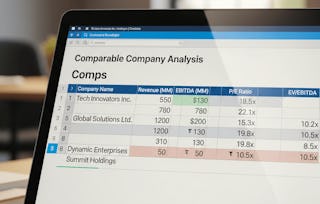

This course equips learners with the knowledge and analytical skills to interpret, calculate, evaluate, and apply key concepts in comparable company valuation (COMPS). Beginning with the foundations of enterprise value and extending through debt and equity adjustments, share price insights, and balance sheet interpretation, participants will analyze profitability metrics, compute growth measures, assess sector-specific performance, and implement advanced valuation techniques such as LTM calculations, calendarization, and currency management.

Comparable Company Valuation – Core Concepts & Methods

Ends soon: Gain next-level skills with Coursera Plus for $199 (regularly $399). Save now.

Skills you'll gain

Details to know

Add to your LinkedIn profile

September 2025

14 assignments

See how employees at top companies are mastering in-demand skills

There are 4 modules in this course

This module provides learners with a comprehensive foundation in comparable company analysis (COMPS) and enterprise value (EV) concepts. It covers the identification and application of trading and transaction comparables, detailed calculation of enterprise value, and integration of debt, net debt, and share-related considerations. Learners will explore how to incorporate pension and lease obligations, determine cash and cash equivalents, and refine net debt calculations. The module emphasizes accurate financial adjustments, ensuring participants can apply real-world valuation methods with precision.

What's included

11 videos3 assignments

This module develops learners’ ability to evaluate advanced share components and financial assets within the context of company valuation. It covers the accurate calculation of basic shares outstanding, application of currency conversions for cross-border analysis, identification of financial assets, and the relationship between revenue, share prices, and trading comparables. By the end of this module, learners will be able to integrate these components into a consistent, comparable framework for valuation purposes.

What's included

8 videos3 assignments

This module equips learners with the skills to interpret and adjust key financial metrics from consolidated financial statements. It covers the calculation of total assets, the role of non-controlling interest, and verification of adjusted financial figures. Learners will also explore adjusted earnings measures, including adjusted EPS and adjusted operating profit, and analyze cash flows from investing activities. Emphasis is placed on integrating these metrics into accurate, comparable valuation models.

What's included

8 videos3 assignments

This module guides learners through the analysis of profitability, growth metrics, sector-specific performance evaluation, working capital adjustments, and advanced valuation techniques such as LTM calculations and calendarization. It explores how to interpret sector examples, measure operational efficiency, calculate adjusted growth rates, and manage currency fluctuations for multinational financial analysis. By the end of the module, learners will be able to align financial periods, assess operational metrics, and apply calendarized and currency-adjusted data to comparable company analysis.

What's included

24 videos5 assignments

Explore more from Finance

Status: Preview

Status: Preview Status: Preview

Status: Preview Status: Preview

Status: Preview Status: Free Trial

Status: Free Trial

Why people choose Coursera for their career

Open new doors with Coursera Plus

Unlimited access to 10,000+ world-class courses, hands-on projects, and job-ready certificate programs - all included in your subscription

Advance your career with an online degree

Earn a degree from world-class universities - 100% online

Join over 3,400 global companies that choose Coursera for Business

Upskill your employees to excel in the digital economy

Frequently asked questions

To access the course materials, assignments and to earn a Certificate, you will need to purchase the Certificate experience when you enroll in a course. You can try a Free Trial instead, or apply for Financial Aid. The course may offer 'Full Course, No Certificate' instead. This option lets you see all course materials, submit required assessments, and get a final grade. This also means that you will not be able to purchase a Certificate experience.

When you purchase a Certificate you get access to all course materials, including graded assignments. Upon completing the course, your electronic Certificate will be added to your Accomplishments page - from there, you can print your Certificate or add it to your LinkedIn profile.

Yes. In select learning programs, you can apply for financial aid or a scholarship if you can’t afford the enrollment fee. If fin aid or scholarship is available for your learning program selection, you’ll find a link to apply on the description page.

More questions

Financial aid available,