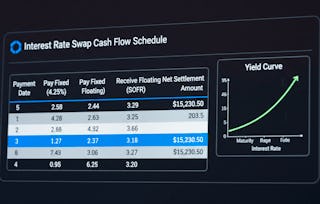

Learners will be able to explain financial instruments, analyze derivative applications, evaluate hedge accounting methods, and apply SFAS 133 standards in real-world scenarios. By the end of the course, participants will confidently record derivative transactions, interpret fair value and cash flow hedges, and assess their impact on financial statements.

Hedge Accounting for Derivatives: Apply & Evaluate

Hedge Accounting for Derivatives: Apply & Evaluate

This course is part of Hedge Funds Mastery: Strategies, Risk & Accounting Specialization

Instructor: EDUCBA

Access provided by ExxonMobil

Gain insight into a topic and learn the fundamentals.

6 hours to complete

Flexible schedule

Learn at your own pace

What you'll learn

Explain financial instruments and derivative applications.

Apply SFAS 133 to record and interpret hedge transactions.

Evaluate fair value, cash flow hedges, and reporting impacts.

Details to know

Shareable certificate

Add to your LinkedIn profile

Assessments

8 assignments

Taught in English

Recently updated!

October 2025

See how employees at top companies are mastering in-demand skills

Build your subject-matter expertise

This course is part of the Hedge Funds Mastery: Strategies, Risk & Accounting Specialization

When you enroll in this course, you'll also be enrolled in this Specialization.

- Learn new concepts from industry experts

- Gain a foundational understanding of a subject or tool

- Develop job-relevant skills with hands-on projects

- Earn a shareable career certificate

Why people choose Coursera for their career

Felipe M.

Learner since 2018

"To be able to take courses at my own pace and rhythm has been an amazing experience. I can learn whenever it fits my schedule and mood."

Jennifer J.

Learner since 2020

"I directly applied the concepts and skills I learned from my courses to an exciting new project at work."

Larry W.

Learner since 2021

"When I need courses on topics that my university doesn't offer, Coursera is one of the best places to go."

Chaitanya A.

"Learning isn't just about being better at your job: it's so much more than that. Coursera allows me to learn without limits."