By the end of this course, learners will be able to analyze banking and credit systems, apply machine learning techniques for fraud detection, evaluate financial risk using efficiency models, and interpret profitability reports to support data-driven decisions. Learners will gain the ability to assess credit risk, detect fraudulent payment patterns, and evaluate operational efficiency using industry-relevant analytical frameworks.

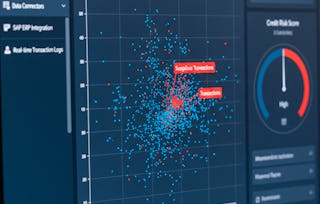

Analyze Financial Fraud Using Machine Learning Analytics

Analyze Financial Fraud Using Machine Learning Analytics

This course is part of Apply Machine Learning for Predictive Business Analytics Specialization

Instructor: EDUCBA

Access provided by US Postal Service

Recommended experience

What you'll learn

Analyze banking, credit, and payment systems to identify fraud and risk patterns.

Apply machine learning and efficiency models to detect fraud and assess performance.

Interpret risk, profitability, and efficiency outputs for data-driven financial decisions.

Skills you'll gain

- Lending and Underwriting

- Financial Systems

- Data-Driven Decision-Making

- Risk Modeling

- Statistical Machine Learning

- Regulatory Compliance

- Anomaly Detection

- Financial Data

- Operational Analysis

- Financial Industry Regulatory Authorities

- Profit and Loss (P&L) Management

- Applied Machine Learning

- Financial Regulation

- Skills section collapsed. Showing 8 of 13 skills.

Details to know

Add to your LinkedIn profile

12 assignments

February 2026

See how employees at top companies are mastering in-demand skills

Build your subject-matter expertise

- Learn new concepts from industry experts

- Gain a foundational understanding of a subject or tool

- Develop job-relevant skills with hands-on projects

- Earn a shareable career certificate

There are 3 modules in this course

This module introduces learners to the structure of the banking system, core credit evaluation concepts, and foundational machine learning techniques used in fraud detection. Learners explore how financial institutions assess borrower risk, apply logistic regression for credit classification, and evaluate fraud prediction models using performance metrics critical to regulated financial environments.

What's included

6 videos4 assignments

This module focuses on applied fraud detection within credit payment systems, emphasizing real-time risk evaluation, analytics setup, and market-driven risk considerations. Learners examine fraud model evaluation metrics, analytics infrastructure, and efficiency benchmarking techniques used to assess trading and financial market operations.

What's included

6 videos4 assignments

This module advances learners into efficiency modeling, profitability analysis, and constraint-based decision frameworks used in financial fraud analytics. Learners apply DEA models, interpret profit and loss reports, and compare Variable and Constant Returns to Scale assumptions to support data-driven fraud and operational decisions.

What's included

6 videos4 assignments

Earn a career certificate

Add this credential to your LinkedIn profile, resume, or CV. Share it on social media and in your performance review.

Why people choose Coursera for their career

Felipe M.

Jennifer J.

Larry W.