- Browse

- Indirect Tax

Results for "indirect tax"

Status: Free TrialFree TrialP

Status: Free TrialFree TrialPPwC India

Skills you'll gain: Tax Returns, Tax Compliance, Compliance Management, Registration, Tax, Regulatory Requirements, Reconciliation, E-Commerce

Beginner · Course · 1 - 4 Weeks

Status: Free TrialFree Trial

Status: Free TrialFree TrialSkills you'll gain: Accounting Records, Invoicing, Billing & Invoicing, Key Performance Indicators (KPIs), Compliance Management, Billing, Tax Compliance, Record Keeping, Accounting, Records Management, Document Control, Tax Management, Performance Reporting, Regulatory Compliance, Reconciliation, Performance Analysis, Data Collection

Beginner · Course · 1 - 4 Weeks

Status: PreviewPreviewU

Status: PreviewPreviewUUniversity of Pennsylvania

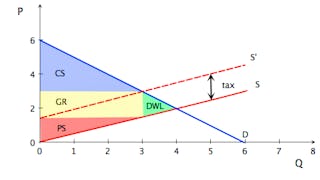

Skills you'll gain: Supply And Demand, Economics, Market Dynamics, Market Analysis, Resource Allocation, Policy Analysis, Tax, Consumer Behaviour, Cost Benefit Analysis, Decision Making

4.8·Rating, 4.8 out of 5 stars1.7K reviewsMixed · Course · 1 - 3 Months

U

UUniversidades Anáhuac

Skills you'll gain: Commercial Laws, Tax Laws, Vendor Contracts, Law, Regulation, and Compliance, International Relations, Export Control, Legal Risk, Economics, E-Commerce, Financial Regulation, Legal Research, Banking, Investments

4.9·Rating, 4.9 out of 5 stars15 reviewsBeginner · Course · 1 - 3 Months

Status: Free TrialFree Trial

Status: Free TrialFree TrialSkills you'll gain: Case Studies, Business Valuation, Export Control, Tax Compliance, Tax, Tax Laws, Intercompany Accounting, Analysis, Commercial Laws, Problem Solving, Investigation, Regulation and Legal Compliance

Beginner · Course · 1 - 4 Weeks

Status: Free TrialFree TrialF

Status: Free TrialFree TrialFFundação Instituto de Administração

Skills you'll gain: International Relations, Tax, Export Control, Global Marketing, Economics, Tax Compliance, Market Opportunities, Market Research, Culture, Business Strategy

4.8·Rating, 4.8 out of 5 stars53 reviewsBeginner · Course · 1 - 4 Weeks

Status: Free TrialFree TrialA

Status: Free TrialFree TrialAAutomatic Data Processing, Inc. (ADP)

Skills you'll gain: Payroll Tax, Payroll Administration, Payroll, Payroll Reporting, Payroll Processing, Tax Compliance, Tax Management, Income Tax, Tax Laws, Compensation Management, Compliance Reporting, Benefits Administration, Compensation and Benefits

4.9·Rating, 4.9 out of 5 stars52 reviewsBeginner · Course · 1 - 4 Weeks

Status: PreviewPreviewL

Status: PreviewPreviewLLund University

Skills you'll gain: Legal Technology, Law, Regulation, and Compliance, Responsible AI, Artificial Intelligence, Legal Risk, Labor Law, Intellectual Property, Governance, Criminal Investigation and Forensics, Health Care Procedure and Regulation, Public Administration

4.7·Rating, 4.7 out of 5 stars784 reviewsBeginner · Course · 1 - 4 Weeks

Status: Free TrialFree TrialU

Status: Free TrialFree TrialUUniversity of Illinois Urbana-Champaign

Skills you'll gain: Financial Statement Analysis, Mergers & Acquisitions, Corporate Accounting, Financial Modeling, Corporate Tax, Private Equity, Investment Banking, Financial Analysis, Corporate Finance, Tax, Financial Accounting, Accounting, Equities, Consolidation

4.5·Rating, 4.5 out of 5 stars25 reviewsIntermediate · Course · 1 - 4 Weeks

Status: Free TrialFree TrialU

Status: Free TrialFree TrialUUniversity of Pennsylvania

Skills you'll gain: Operations Management, Operational Efficiency, Process Analysis, Process Management, Process Improvement, Lean Methodologies, Workflow Management, Continuous Improvement Process, Capacity Planning, Quality Management, Supply Chain Management, Inventory Management System, Statistical Process Controls, Process Flow Diagrams, Root Cause Analysis

4.5·Rating, 4.5 out of 5 stars2.9K reviewsBeginner · Course · 1 - 4 Weeks

Status: Free TrialFree TrialR

Status: Free TrialFree TrialRRutgers the State University of New Jersey

Skills you'll gain: Warehouse Management, Inventory and Warehousing, Inventory Management System, Transportation, Supply Chain, and Logistics, Logistics, Transportation Operations, Supply Chain Management, Supply Chain, Customer Service, Operating Cost

4.7·Rating, 4.7 out of 5 stars12K reviewsBeginner · Course · 1 - 4 Weeks

Status: Free TrialFree Trial

Status: Free TrialFree TrialSkills you'll gain: Tax Compliance, Registration, Export Control, Tax, Claims Processing, Compliance Reporting, Tax Laws, Invoicing, Regulation and Legal Compliance, Timelines, Problem Solving

Beginner · Course · 1 - 4 Weeks

Searches related to indirect tax

In summary, here are 10 of our most popular indirect tax courses

- GST - Undertaking compliances: PwC India

- GST - Maintaining documents, accounts and records: PwC India

- Microeconomics: The Power of Markets: University of Pennsylvania

- Fundamentos de Derecho Mercantil Internacional: Universidades Anáhuac

- Classification and valuation - What you must know!: PwC India

- Relações Internacionais: Fundação Instituto de Administração

- Advancing Proficiency in U.S. Payroll Fundamentals: Automatic Data Processing, Inc. (ADP)

- AI & Law : Lund University

- Accounting for Mergers and Acquisitions: Advanced Topics: University of Illinois Urbana-Champaign

- Introduction to Operations Management: University of Pennsylvania