- Browse

- Tax Laws

Results for "tax laws"

Status: PreviewPreviewU

Status: PreviewPreviewUUniversity of Illinois Urbana-Champaign

Skills you'll gain: Governance, Compliance Management, Business Ethics, Certified Public Accountant, Regulatory Compliance, Corporate Accounting, Ethical Standards And Conduct, Accountability, Public Accounting, Accounting, Auditing, Financial Management, Stakeholder Management

Build toward a degree

4.9·Rating, 4.9 out of 5 stars67 reviewsBeginner · Course · 1 - 4 Weeks

Status: Free TrialFree Trial

Status: Free TrialFree TrialSkills you'll gain: Tax Compliance, Registration, Export Control, Tax, Claims Processing, Compliance Reporting, Tax Laws, Invoicing, Regulation and Legal Compliance, Timelines, Problem Solving

Beginner · Course · 1 - 4 Weeks

Status: Free TrialFree TrialL

Status: Free TrialFree TrialLLund University

Skills you'll gain: Legal Research, Law, Regulation, and Compliance, International Relations, Compliance Management, Environmental Laws, Public Policies, Case Law, Commercial Laws, Economics, Governance

4.8·Rating, 4.8 out of 5 stars1.3K reviewsBeginner · Course · 1 - 3 Months

Status: PreviewPreviewK

Status: PreviewPreviewKKorea Advanced Institute of Science and Technology(KAIST)

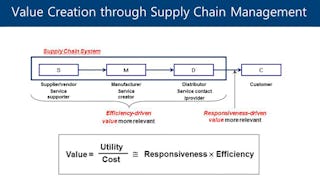

Skills you'll gain: New Product Development, Supply Chain, Supply Chain Management, Supply Chain Planning, Quality Management, Logistics Management, Supplier Management, Inventory Management System, Corporate Sustainability, Coordination, Value Propositions, Operational Efficiency, Continuous Improvement Process, Consumer Behaviour

4.7·Rating, 4.7 out of 5 stars1.8K reviewsMixed · Course · 1 - 3 Months

Status: NewNewStatus: Free TrialFree Trial

Status: NewNewStatus: Free TrialFree TrialSkills you'll gain: Revenue Recognition, Generally Accepted Accounting Principles (GAAP), Technical Accounting, Financial Reporting, Mergers & Acquisitions, Financial Accounting, Tax Management, Consolidation, Equities, Income Tax, Income Statement, Accounting, Financial Statements

Mixed · Course · 1 - 4 Weeks

Status: Free TrialFree TrialU

Status: Free TrialFree TrialUUniversity of Pennsylvania

Skills you'll gain: Health Care Procedure and Regulation, Medicaid, Healthcare Industry Knowledge, Medicare, Managed Care, Health Care Administration, Law, Regulation, and Compliance, Healthcare Ethics, Health Policy, Legal Risk, Lawsuits, Informed Consent, Case Law, Emergency Departments

4.9·Rating, 4.9 out of 5 stars266 reviewsBeginner · Course · 1 - 4 Weeks

Status: Free TrialFree TrialU

Status: Free TrialFree TrialUUniversity of Maryland, College Park

Skills you'll gain: Intellectual Property, Law, Regulation, and Compliance, Entrepreneurship, Business, Commercial Laws, Labor Law, Business Management, Contract Management, Staff Management, New Business Development, Organizational Structure, Corporate Tax

4.8·Rating, 4.8 out of 5 stars83 reviewsBeginner · Course · 1 - 3 Months

Skills you'll gain: Case Studies, Benchmarking, Tax Laws, Corporate Tax, Intercompany Accounting, International Finance, Tax, Analysis

Beginner · Course · 1 - 4 Weeks

Status: Free TrialFree TrialA

Status: Free TrialFree TrialAAutomatic Data Processing, Inc. (ADP)

Skills you'll gain: Payroll Tax, Payroll Administration, Payroll, Payroll Reporting, Payroll Processing, Tax Compliance, Tax Management, Income Tax, Tax Laws, Compensation Management, Compliance Reporting, Benefits Administration, Compensation and Benefits

4.9·Rating, 4.9 out of 5 stars52 reviewsBeginner · Course · 1 - 4 Weeks

Status: Free TrialFree TrialP

Status: Free TrialFree TrialPPwC India

Skills you'll gain: Accounting, Sales Tax, Income Tax, Tax, Tax Laws, Tax Compliance, Billing & Invoicing, Regulatory Compliance, Problem Solving

4.3·Rating, 4.3 out of 5 stars10 reviewsBeginner · Course · 1 - 4 Weeks

Status: Free TrialFree TrialU

Status: Free TrialFree TrialUUniversity of Illinois Urbana-Champaign

Skills you'll gain: Investments, Portfolio Management, Return On Investment, Performance Analysis, Finance, Equities, Behavioral Economics, Asset Management, Portfolio Risk, Tax Planning, Market Trend, Regression Analysis

Build toward a degree

4.8·Rating, 4.8 out of 5 stars883 reviewsIntermediate · Course · 1 - 3 Months

Status: Free TrialFree Trial

Status: Free TrialFree TrialSkills you'll gain: Export Control, Tax Compliance, Regulatory Compliance, Compliance Management, Tax Laws, Tax Management, Commercial Laws, Economics, Document Management

Beginner · Course · 1 - 4 Weeks

In summary, here are 10 of our most popular tax laws courses

- Professional Responsibility and Ethics for Accountants: University of Illinois Urbana-Champaign

- GST - Claiming refunds and other concepts: PwC India

- European Business Law: Understanding the Fundamentals: Lund University

- Supply Chain Management: A Learning Perspective : Korea Advanced Institute of Science and Technology(KAIST)

- Evaluate US GAAP: Equity, Revenue & Advanced Topics: EDUCBA

- U.S. Health Law Fundamentals: University of Pennsylvania

- Legal Foundations for Entrepreneurs: University of Maryland, College Park

- Concept of International transaction, AE and TP Methods: PwC India

- Advancing Proficiency in U.S. Payroll Fundamentals: Automatic Data Processing, Inc. (ADP)

- GST - when, where, who and how much?: PwC India