Filter by

The language used throughout the course, in both instruction and assessments.

186 results for "computational finance"

Skills you'll gain: Computer Programming, Other Programming Languages, Software Engineering, Theoretical Computer Science, Computer Architecture

University of Illinois at Urbana-Champaign

Skills you'll gain: Data Analysis, Business Analysis, R Programming, Data Visualization, Exploratory Data Analysis, Data Analysis Software, Machine Learning, Statistical Machine Learning, Data Management, Interactive Data Visualization, Statistical Programming, Algorithms, Data Model, Extract, Transform, Load, Accounting, Communication, Customer Analysis, Data Mining, Data Visualization Software, Machine Learning Algorithms, Plot (Graphics), Probability & Statistics, Statistical Analysis, Audit, Business Communication, Market Research, Marketing, Natural Language Processing, Regression, Visual Design, Visualization (Computer Graphics), Accounting Software, General Statistics, Market Analysis, Storytelling, Computer Programming

University of Virginia Darden School Foundation

Skills you'll gain: Business Analysis, Business Transformation, Strategy, Data Analysis, Cloud Computing, Strategy and Operations, Applied Machine Learning, Big Data, Data Visualization, Deep Learning, Entrepreneurship, Leadership and Management, Research and Design, Algorithms, Artificial Neural Networks, Computer Vision, Human Learning, Innovation, Machine Learning, Machine Learning Algorithms, Machine Learning Software, Marketing, Sales, Market Analysis, Computational Thinking, Business Design, Business Development, Customer Analysis, Product Strategy, Data Management, Data Mining, Databases, Python Programming, SQL, Cloud Applications, Cloud Infrastructure, Cloud Platforms, Cloud Storage, Data Science, DevOps, IBM Cloud, NoSQL, R Programming, Microsoft Excel

Copenhagen Business School

Skills you'll gain: FinTech, Finance, Innovation, Banking, Business Transformation, Leadership and Management, Payments, Strategy, Strategy and Operations, BlockChain, Business Analysis, Cash Management, Decision Making, Entrepreneurship, Network Analysis, Product Development, Product Strategy, Research and Design, Risk Management

University at Buffalo

Skills you'll gain: BlockChain, Cryptography, Algorithms, Problem Solving, System Security, Adaptability, Critical Thinking, Research and Design, Security Strategy, Theoretical Computer Science

University of Michigan

Skills you'll gain: Computational Thinking, Computer Programming, Entrepreneurship, Leadership and Management, Problem Solving, Research and Design, Theoretical Computer Science, Algorithms

Universidad de los Andes

Skills you'll gain: Algorithms, Computational Logic, Computer Programming, Python Programming, Computational Thinking, Mathematics, Programming Principles, System Programming

Status: Free

Status: FreeYale University

Skills you'll gain: Leadership and Management, Algebra, Problem Solving, Programming Principles, Calculus, Computational Logic, Finance, Strategy, Strategy and Operations

University of Illinois at Urbana-Champaign

Skills you'll gain: Market Analysis, Finance, Business Analysis, Financial Analysis, Data Analysis, Behavioral Economics, Decision Making, Econometrics, Probability & Statistics, Accounting, Banking, General Statistics, Statistical Analysis, Leadership and Management, Basic Descriptive Statistics, Exploratory Data Analysis, Financial Accounting, Financial Management, Strategy and Operations, Investment Management, Market Research, Probability Distribution, Regulations and Compliance, Marketing, Risk Management, Securities Trading, Statistical Tests, Correlation And Dependence, Mathematics, Securities Sales, Strategy, Taxes, Game Theory, Microsoft Excel

University of Virginia

Skills you'll gain: Strategy, Strategy and Operations, Leadership and Management, Entrepreneurship, Marketing, Sales, Market Analysis, Business Development, Business Analysis, Business Transformation, Finance, Investment Management, Planning, Product Strategy, Business Design, Mergers & Acquisitions, Research and Design

University of Illinois at Urbana-Champaign

Skills you'll gain: Entrepreneurship, Leadership and Management, Innovation, Strategy, Strategy and Operations, Research and Design, Creativity, Critical Thinking, Marketing, Business Psychology, Decision Making, Business Analysis, Business Development, Communication, Human Learning, Leadership Development, Problem Solving, People Analysis, Product Development, Sales, Collaboration, Emotional Intelligence, Product Strategy, Business Design, Customer Analysis, Human Resources, People Management, Storytelling, Entrepreneurial Finance, Finance

Università di Napoli Federico II

In summary, here are 10 of our most popular computational finance courses

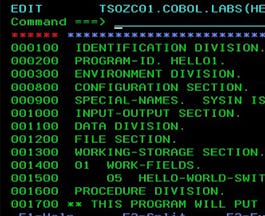

- IBM Mainframe Developer: IBM

- Business Analytics: University of Illinois at Urbana-Champaign

- IBM & Darden Digital Strategy: University of Virginia Darden School Foundation

- Digital Transformation in Financial Services: Copenhagen Business School

- Blockchain Basics: University at Buffalo

- Problem Solving Using Computational Thinking: University of Michigan

- Programación en Python: Universidad de los Andes

- الأسواق المالية: Yale University

- Managerial Economics and Business Analysis: University of Illinois at Urbana-Champaign

- Business Strategy: University of Virginia