Filter by

The language used throughout the course, in both instruction and assessments.

15 results for "income tax regualtion"

Tally Education and Distribution Services Private Limited

University of Illinois at Urbana-Champaign

University of Illinois at Urbana-Champaign

Skills you'll gain: Behavioral Economics, Decision Making, Market Research, Market Analysis, Strategy, Problem Solving, Business Analysis, Data Analysis, Financial Management

Status: Free

Status: Free Status: Free

Status: FreeErasmus University Rotterdam

Skills you'll gain: Data Analysis

Status: Free

Status: FreeUniversity of Pennsylvania

Skills you'll gain: Problem Solving, Market Analysis, Behavioral Economics, Business Analysis, Decision Making, Finance, Market Research, Mathematics, Supply Chain and Logistics

University of Illinois at Urbana-Champaign

Skills you'll gain: Accounting, Taxes, Critical Thinking, Finance, Financial Accounting, General Accounting, Problem Solving, Regulations and Compliance, Generally Accepted Accounting Principles (GAAP), Benefits

Status: Free

Status: FreeUniversity of Pennsylvania

Skills you'll gain: Critical Thinking, Market Analysis, Finance, Business Analysis, Cost Accounting, Marketing, Strategy, Accounting

Starweaver

Goodwill Industries International

Skills you'll gain: Leadership and Management

University of Illinois at Urbana-Champaign

Skills you'll gain: Accounting, Taxes, Financial Accounting, Finance, Corporate Accouting, Financial Analysis, General Accounting, Regulations and Compliance, Critical Thinking

University of Illinois at Urbana-Champaign

Skills you'll gain: Accounting, Taxes

In summary, here are 10 of our most popular income tax regualtion courses

- Payroll & HR Management: Tally Education and Distribution Services Private Limited

- Alternative Investments and Taxes: Cracking the Code: University of Illinois at Urbana-Champaign

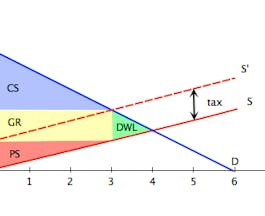

- Microeconomics Principles: University of Illinois at Urbana-Champaign

- Politics and Economics of International Energy: Sciences Po

- Earth Economics: Erasmus University Rotterdam

- Microeconomics: The Power of Markets: University of Pennsylvania

- Federal Taxation I: Individuals, Employees, and Sole Proprietors: University of Illinois at Urbana-Champaign

- Microeconomics: When Markets Fail: University of Pennsylvania

- Tools and Techniques for Managing Stress: Starweaver

- Supporting Clients: Goodwill Industries International